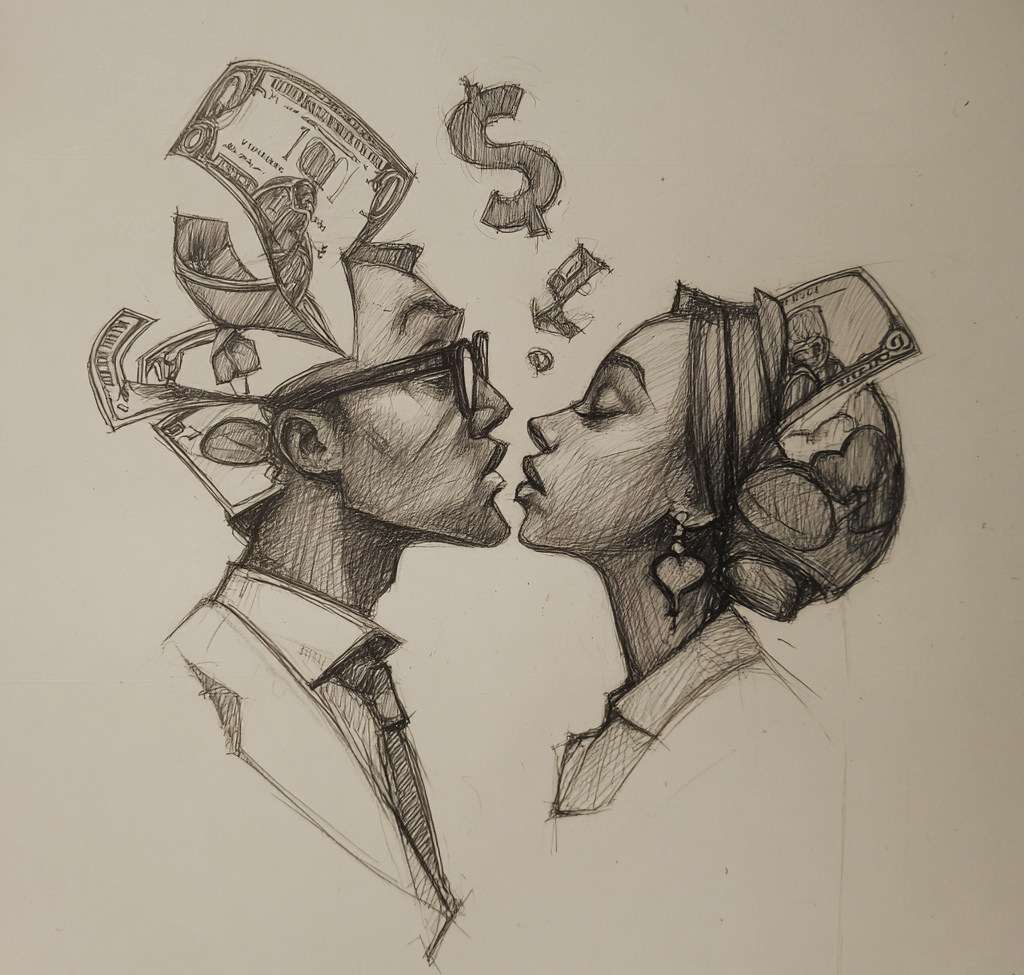

Love and Money: Why Financial Values Matter When Finding “The One”

Financial planning doesn’t kill romance—it strengthens it. It’s saying, “I see a future with you, and I want us to be ready for it.”

Love and Finances

When you’re falling for someone new, money is probably the last thing on your mind. You’re caught up in the excitement — the late-night talks, shared playlists, and that fluttery feeling when they text back. You’re thinking about chemistry, not credit scores.

And honestly, that’s how it should be — at least at first. Love should feel effortless, not transactional.

But here’s the truth: while money doesn’t create love, it often determines whether love can last. Different financial values, spending habits, or even the silence around money can quietly chip away at connection over time.

Love isn’t sustained by butterflies alone — it thrives on trust, communication, and shared goals. And whether we like it or not, money is tied to all three.

It’s not just a married-people issue either. Even in the early stages, how someone views money can reveal how they view you — their sense of responsibility, respect, and priorities.

Money might seem like the least romantic topic when you’re still figuring out each other’s coffee orders, but here’s the twist: how someone handles their wallet often hints at how they’ll handle your heart.

When Love Meets Money

Here’s the thing — money can stir up just as many emotions as love does. Excitement, fear, guilt, even pride. It’s deeply personal, and that’s why it can also be deeply powerful in relationships. Money touches almost every part of a relationship, housing, travel, children, lifestyle, and retirement. Couples who avoid talking about finances often run into conflict and misunderstanding.

According to a 2023 Ramsey Solutions study, money arguments are the second leading cause of divorce, right behind infidelity. Even more telling? Nearly two-thirds of marriages start in debt, and one in three people who argue with their partner about money admit to hiding purchases from them.

That’s not just about numbers — it’s about trust.

When one person hides a purchase or avoids the conversation altogether, it’s rarely about the money itself. It’s about honesty, fear of judgment, or a sense of control. And those things can quietly chip away at connection faster than a maxed-out credit card ever could.

Even the perception of how your partner spends, saves, or borrows can shape how safe you feel in the relationship. If you sense recklessness, it can create anxiety. If you sense control, it can feel suffocating. The American Psychological Association (2022) found that 65% of adults say money is a significant source of stress in their lives. So it’s no wonder that financial tension doesn’t just live in your wallet — it shows up in your emotions, your communication, and your sense of peace with each other.

Money isn’t just currency; it’s energy. And how we handle it — or avoid it — often reflects how we handle love itself. The real question is – should the conversation be visited before thinking about having the relationship? While getting to know each other should the conversation of money be discussed?

Let’s find out!

Why Money Matters in Relationships

Here’s why financial alignment—and honest communication about it—matters for both love and longevity:

| Compatibility 💞 | Money habits reveal values. One partner may love to save, while the other enjoys spending freely—and that’s okay, as long as you understand and respect each other’s styles. Financial compatibility doesn’t mean identical habits; it means shared priorities. |

| Security 🛡️ | Money isn’t everything, but financial strain or imbalance can easily breed resentment or stress. Feeling safe emotionally and financially—creates stability for love to grow. |

| Trust 🤝 | Talking about money builds transparency. According to the National Endowment for Financial Education (2022), 43% of people who share finances admit to some form of “financial infidelity,” like hiding a purchase or secret account. Open conversations prevent those cracks before they start. |

| Stress and Conflict 💬 | Money disagreements can turn small frustrations into big fights. They test communication and compromise. Addressing finances early helps keep stress from overshadowing intimacy. |

| Shared Goals 🎯 | When you budget or invest together, you’re not just managing numbers—you’re building dreams. Whether it’s saving for a trip, buying a home, or investing for your future, shared financial goals strengthen your bond as a team. |

“But Does It Really Matter If We’re Only Dating?

Absolutely. The dating stage is when you get to know who someone is—how they think, what they value, and how they handle challenges.

Money is a reflection of mindset. Someone who plans, saves, or invests shows foresight and discipline. Someone who avoids talking about money may have fears or habits that could affect your future together.

You don’t need to compare credit scores over dinner, but you should talk about values. Ask questions like:

- What does financial security mean to you?

- How do you balance saving and enjoying life?

- What are your biggest money goals or fears?

These conversations help you see if your values align—not your incomes, but your outlooks.

Building Financial Intimacy

When your relationship deepens, so should your financial conversations. Try:

- Creating a shared budget that reflects both your goals and lifestyles.

- Choosing account types—joint, separate, or hybrid—that work for your comfort level.

- Setting savings or investment goals together for something meaningful.

Financial planning doesn’t kill romance—it strengthens it. It’s saying, “I see a future with you, and I want us to be ready for it.”

The Bottom Line

In the end, finding “the one” isn’t just about who makes your heart race. It’s about who helps your life make sense.

Money and love might seem like opposites — one logical, one emotional — but when they align, they create something powerful: security, freedom, and peace. When two people align their financial values, they’re not just managing money—they’re building a life.

So yes, talk about investments, savings, and spending habits — not to kill the vibe, but to protect it. It’s knowing you’ve found someone who values what you value, loves how you love, and spends their energy — and their money — on building us. Because in both love and finance, the best returns come from long-term commitment, honest communication, and shared goals.

References

- American Psychological Association. (2022). Stress in America™: Money and Financial Stress.

- National Endowment for Financial Education (NEFE). (2022). Financial Infidelity in Relationships Study.

- Ramsey Solutions. (2023). The State of Marriage & Money: How Finances Impact Relationships in America.

- Pew Research Center. (2023). Financial Well-being and Relationship Satisfaction Among U.S. Adults.